In a statement, the foundation – established by the founder of Alibaba Group Holding and Ant Group – expressed solidarity with all those affected by the tragedy. Alibaba owns the South China Morning Post.

The donation follows a further commitment of HK$20 million from Alibaba and HK$10 million from Ant, bringing their total contribution to HK$60 million and making them the largest contributors among Chinese tech giants in providing financial assistance to victims of the fire, which has killed at least 55 people, including a firefighter.

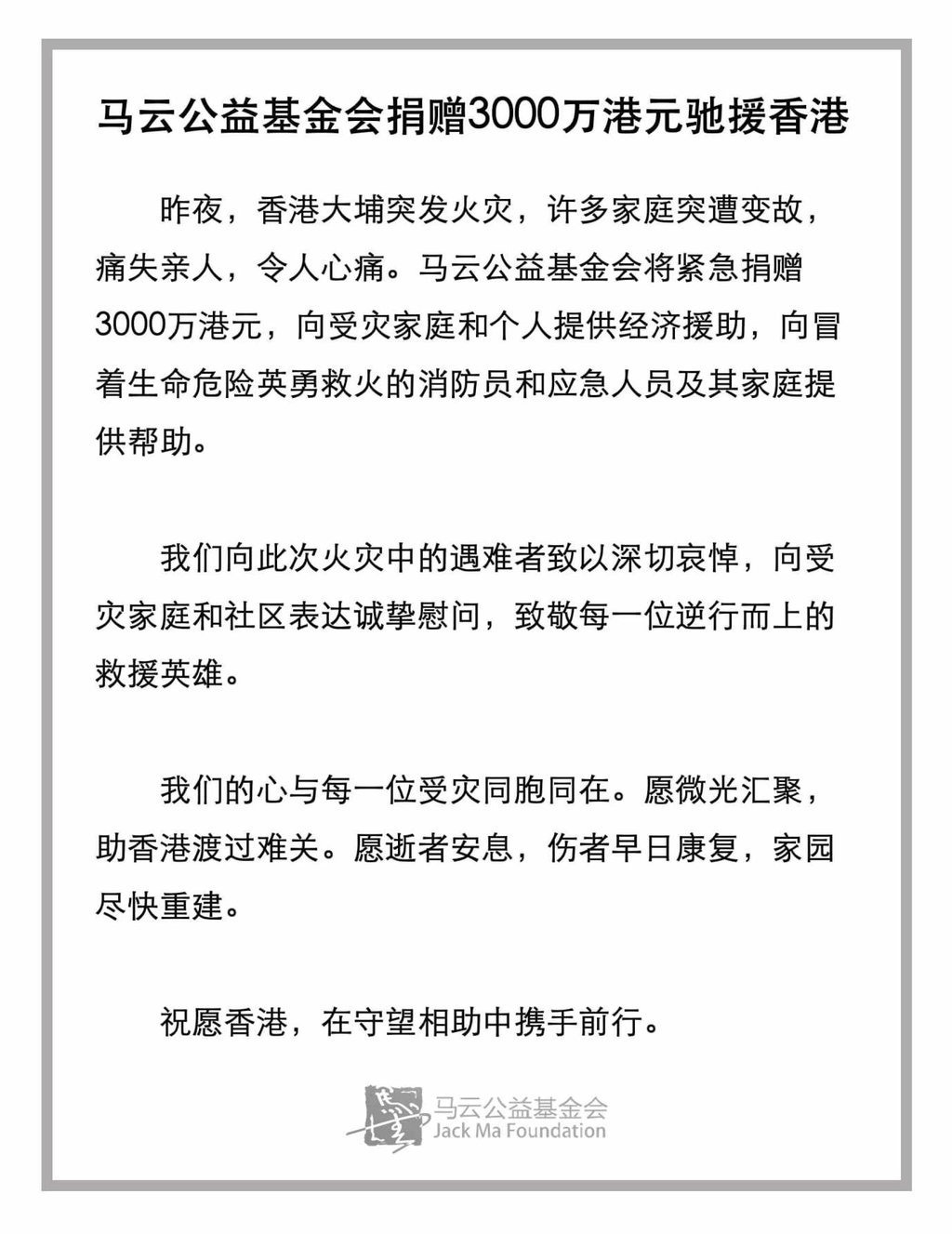

The Jack Ma Foundation extended its condolences to the victims’ families and praised the bravery of the firefighters and emergency personnel.

Alibaba said it had released the first phase of its donation to support rescue efforts and temporary shelters, and to provide essential materials. The company also activated its emergency response mechanism, with its logistics unit Cainiao delivering clothing and food for those in need.