[The content of this article has been produced by our advertising partner.]

DBS Bank (Hong Kong) Limited (“DBS Hong Kong”) is pressing ahead with a three-year plan to recruit 100 wealth managers in Hong Kong, a substantial expansion that bets on the city’s entrenched role as a safe haven for capital during periods of global uncertainty.

The move by the Singaporean lender, which holds the title of Asia’s Safest Bank for a 17th consecutive year, is a direct response to strengthening demand from high-net worth clients who now value stability above all else, ensuring their wealth is in secure hands.

It is a considerable wager on Hong Kong’s position as a premier wealth junction. The city’s asset and wealth management sector held over HK$30.5tn in total assets as of late 2022, according to the Securities and Futures Commission’s Asset and Wealth Management Activities Survey 2023, with private banking assets growing more than 20 per cent from 2019 to 2022.

Government initiatives, such as a drive to attract 200 family offices to the city by 2025, are designed to cement this status further.

For DBS Hong Kong, the calculus is clear. In a fragmented world, the ability to provide a trusted harbour, underpinned by a physical network and expert knowledge of the region, catering to both personal wealth and commercial banking needs, will attract assets.

“Clients look for trust, reliability and expertise when markets are unpredictable,” said Ajay Mathur, Head of Consumer Banking Group and Wealth Management at DBS Hong Kong.

He noted a shift where capital preservation and income stability are now seen by many investors to be as important as the pursuit of returns. This search for sanctuary is fundamental to the bank’s strategy.

The recruitment drive services what the bank terms considerable opportunities in offshore and cross-border wealth, with a particular focus on mainland China. This focus is already bearing fruit, with the bank reporting strong growth in new-to-wealth customers.

A strategy built on access and insight

The expansion is a vote of confidence in Hong Kong’s fundamental strengths as a gateway. Mathur cited the city’s “unparalleled access to both China and global capital markets” as its key advantage, supported by its mature financial infrastructure.

DBS’s own heft is used to reassure clients; its “AA-” and “Aa2” credit ratings are among the highest globally.

The bank’s extensive network across Asia, with deep roots in key wealth hubs like Singapore and Hong Kong and a profound understanding of the region, provides a platform for clients whose lives and investments span borders. A DBS Treasures client finds their relationship recognised across this network, allowing for smoother international banking.

To further capture offshore wealth, the bank has recently launched a simplified digital account opening service for clients outside Hong Kong in selected Asian markets. A material part of the growth plan is tethered to deeper connections with Mainland China, specifically the Greater Bay Area.

DBS Hong Kong was an early participant in the Wealth Management Connect (WMC) scheme with three “southbound connect” partner banks on the Mainland. The improved WMC 2.0 framework has allowed DBS Hong Kong to offer over 220 WMC Southbound eligible investment products to Greater Bay Area residents.

“These improvements offer a wider array of investment choices,” Mathur explained, noting that bank had established a dedicated team fluent in Mandarin, Cantonese and English to serve this group.

Digital tools and human counsel

Digital tools are a key part of the service model, intended to support, not replace, personal relationships.

Mathur described the approach as “Digital Breadth, Human Depth”. Branches are being reconfigured into client experience centres, blending digital efficiency with personal service. “Wealth management remains a relationship-led business, amplified by tech,” he said.

Relationship managers use data analytics and AI, fed by insights from the bank’s internal Chief Investment Office, to inform their counsel, amplified by Next Best Conversation (NBC) tools that equip wealth managers with personalised talking points to proactively offer tailored wealth solutions. The bank is also applying generative AI in Next Best Nudges to give clients timely insights and targeted communications.

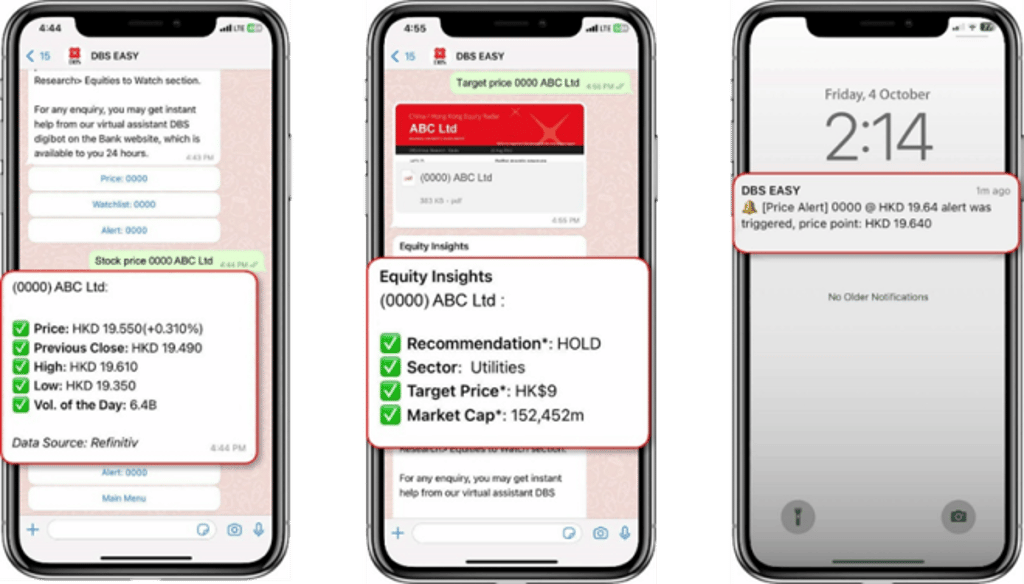

For clients, this translates to practical tools. A refreshed digital equities trading platform is particularly unique, offers access to eight major global stock markets, including those in Hong Kong, the US and Japan from a single, seamless platform. Innovations like “DBS EASY”, the bank’s WhatsApp intelligent stock assistant, further simplify the trading experience, ensuring clients stay ahead of market trends.

“We are truly committed to being a ‘Gen AI-enabled bank with a heart’… Our goal is to continuously elevate service excellence and exceed customer expectations throughout their wealth management journey with DBS,” said Mathur.

DBS Hong Kong provides access to a range of over 250 funds and equity trading across these eight markets, forming part of a suite that includes DBS-exclusive products. It has also introduced odd-lot trading and a new digital platform for equity-linked investments.

Looking forward, the main objective for DBS Treasures is to aid clients in making informed decisions for managing, protecting and transferring wealth over the long term.

At a time when the future of financial hubs in Asia is debated, DBS’s considerable investment in Hong Kong suggests the city’s role as Asia’s definitive wealth bridge is being reinforced, solidifying its position as Asia’s Wealth Gateway for their financial aspirations.