Shares of Shanghai Biren Technology jumped 82.1 per cent upon their debut on Friday in Hong Kong’s first listing of the year, as investors piled into the Chinese graphics processing unit (GPU) maker amid the artificial intelligence wave.

The first of China’s up-and-coming GPU developers to list in Hong Kong, the company’s shares first changed hands at HK$35.70, up from the initial public offering (IPO) price of HK$19.60, valuing the company at HK$85.5 billion (US$11 billion). Biren raised HK$5.58 billion after exercising an option to adjust the offer size to accommodate strong investor appetite.

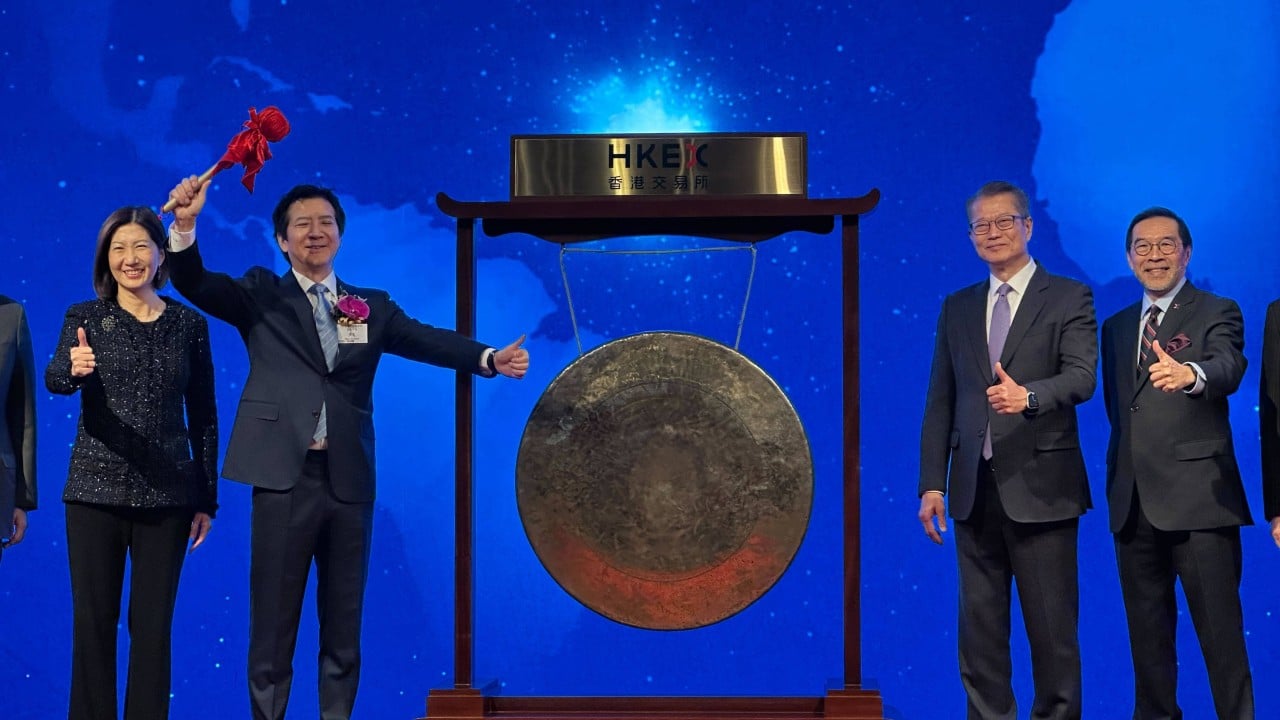

“We see Hong Kong’s favourable business environment and efficient connectivity with global capital as a vital platform for the growth of hard‑tech and other companies here,” said Zhang Wen, chairman and CEO of Biren, at the listing ceremony at Hong Kong Exchanges and Clearing (HKEX) in Central.

“We are determined to invest in technological innovation and to run our business in a diligent and responsible manner, creating long‑term value for shareholders, employees and society, and repaying every measure of trust without squandering the opportunities afforded by this era.”